Best-in-class Funds

Galix Investments has selected a small number of prime funds in differentiated investment strategies, which we make available to qualified investors. Galix acts as the official distributor for those products in Switzerland. Our distribution services come at no extra cost for the investor.

Our selection covers high potential and niche areas that we believe remain underinvested in most portfolios. The funds are managed by teams of experienced, locally-based specialists.

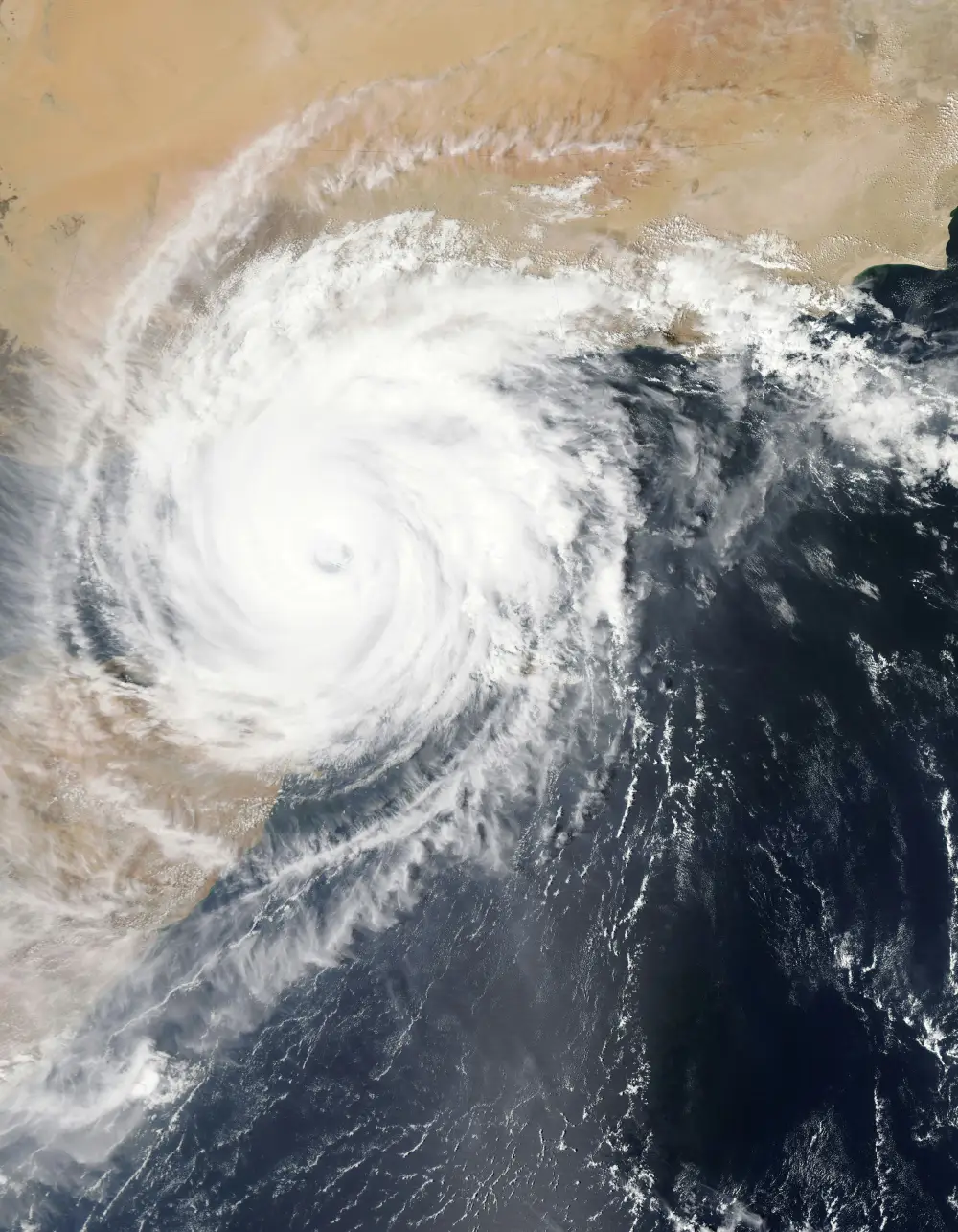

Cat Bonds / ILS

Diversify your portfolio

Insurance-Linked Strategies are innovative investment solutions that transfer insurance risk to the capital markets. Investors in ILS are compensated through insurance premiums for assuming the risk of extreme natural catastrophes such as earthquakes and hurricanes. Because the occurrence of such events is unrelated to financial market movements, ILS investments offer returns that are largely uncorrelated with traditional asset classes—making them powerful tools for portfolio diversification.

Beyond financial benefits, ILS investments deliver meaningful social and environmental impact. Investors are aligned with global efforts to mitigate the effects of climate change by supporting rapid recovery and resilience in the face of natural disasters. These investments facilitate the timely reconstruction of infrastructure and help reduce the risk of poverty following major catastrophes.

Galix Investments offers access to a best-in-class solution in this highly specialized and impactful investment strategy.

Chinese Equities

Tap into China's dynamic Growth

China’s economic landscape is undergoing a profound transformation. At the heart of this evolution is the rapid expansion of its middle class, already the largest in the world. This shift is fuelling a surge in domestic consumption, rising demand for quality services, and a growing appetite for financial products, healthcare, education, and premium consumer goods. As incomes rise, so does the sophistication and diversification of spending, creating robust, long-term opportunities for investors across multiple sectors.

In parallel, China is cementing its position as a global leader in innovation. From artificial intelligence and electric vehicles to renewable energy and advanced manufacturing, the country is at the forefront of next-generation technologies. Government policies continue to strongly support technological self-sufficiency, green development, and digital infrastructure, all of which serve as powerful tailwinds for high-growth companies.

However, cultural nuances and language barriers can pose challenges for international investors. why Galix Investments has partnered with an award-winning asset manager based in Hong Kong, providing you with access to a fund that boasts a strong and proven track record in Chinese equities.

Indian Equities

Capture India’s Economic Transition

India is progressing from a low-income to a middle-income economy, a shift that historically marks an inflection point for accelerated growth. In 2020–21, India’s GDP per capita surpassed USD 2,000, opening the door to a wave of consumption, infrastructure development, and innovation. Global investors are increasingly looking to capitalize on this structural transformation by targeting sectors that drive the country’s economic expansion. Our strategy is built around identifying powerful macroeconomic themes shaping India’s future and investing in the sectors that best reflect those trends.

Galix Investments provides access to a seasoned manager with a focused, top-down investment approach and a strong performance track record. Unlike many India-focused funds that benchmark against an index, this strategy is benchmark-agnostic and targets absolute returns.